What is crypto lending? An example with Cardano

How does lending work and what are the risks?

By Adam Beddall published 10/02/2023

Crypto lending is leasing out your cryptocurrency to a borrower in return for regular interest payments. The borrower may be looking to use your crypto to enable big transactions, to which you are paid in crypto for enabling their transactions. It is often seen as an alternative to staking or an option for cryptocurrencies that do not offer staking.

As an example, if you lend ADA (Cardano) and you leased it out on a lending platform such as Binance Earn or Kucoin Lend. You would then begin to earn interest payments every week or month providing your crypto has been used by borrowers. The interest rates can vary so what you may receive in one payment may not be the same as the next. With some crypto the interest rate could be as high as 17% or as little as 3% all dependant on the platform and the crypto you have leased out.

Typically, you will receive higher rewards for lending than staking but it does have higher risks. The rewards for lending are split between the exchange, the insurance fund, and yourself.

As a borrower the amount of loan you can receive is calculated based on how much collateral you stake. This calculation is called a loan-to-value (LTV) ratio. For example, a platform may have an LTV of 50% which means the borrower would have to stake £5000 of crypto to get a loan of £2500. During the loan the borrower will not be able to trade or sell their collateral until the loan is paid in full.

Risks

After the borrower has used your crypto for the require transaction or other requirement, they should pay back your crypto. However, they may not pay it back and leave you without your leased funds. This is the biggest risk with lending and one that cannot always be mitigated by yourself and the platform you have chosen.

Most exchange platforms hold an insurance fund for this scenarios to give you back what you lent out – Or hopefully at least some of it.

It is extremely important to be very familiar with the platform(s) you choose to lend on and read through all their fine print regarding insurance and processes.

Platform examples

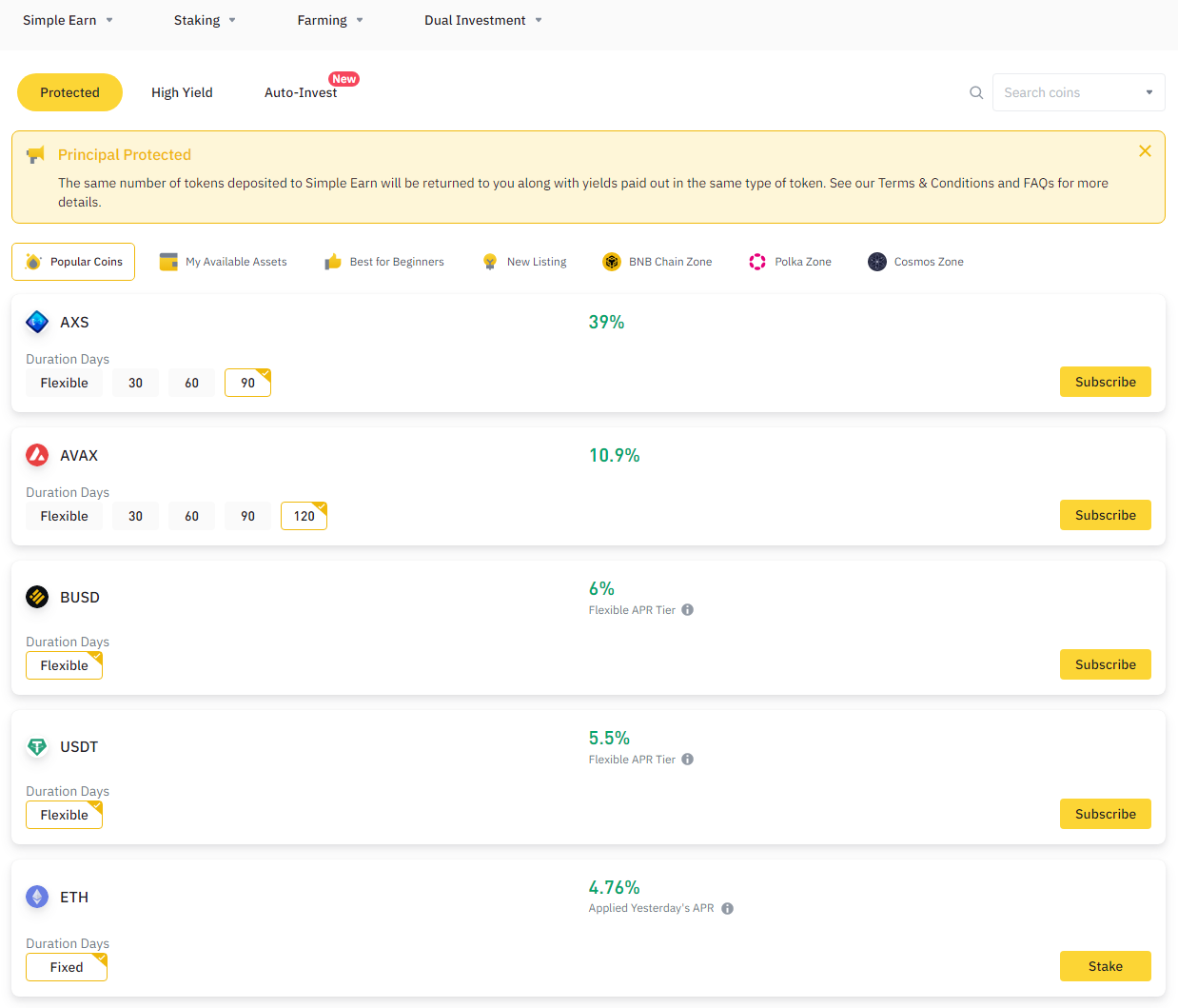

Binance Earn

Pictured below, Binance Earn is Binance's one-stop shop for crypto lending and other risk-reward based alternatives.

You can switch between the different types of mechanisms to find the most suitable.

Kucoin Lend

Pictured below, Kucoin Lend is Kucoin's crypto lending section. On the left you can select which crypto to lend. In the middle you can select the term and the amount to lend. On the right are borrower transactions requiring your crypto.

As you can see there are a variety of interest rates so you can tailor your lending to match specific transactions.

Summary

Crypto lending is a higher risk alternative to staking. Lending can be very flexible and can lead to higher rewards than staking. However, it is extremely important to protect your assets at all times and be aware of all the risks which may vary from platform-to-platform. Always check the fine print and make sure the platform carries an insurance fund.

As always never share your wallet password or 24-word phrase with anyone. Keep a backup in a secure location. Be wary of scams.